Sign Up With a Credit Union in Wyoming: Personalized Financial Services for You

Sign Up With a Credit Union in Wyoming: Personalized Financial Services for You

Blog Article

Elevate Your Banking Experience With Lending Institution

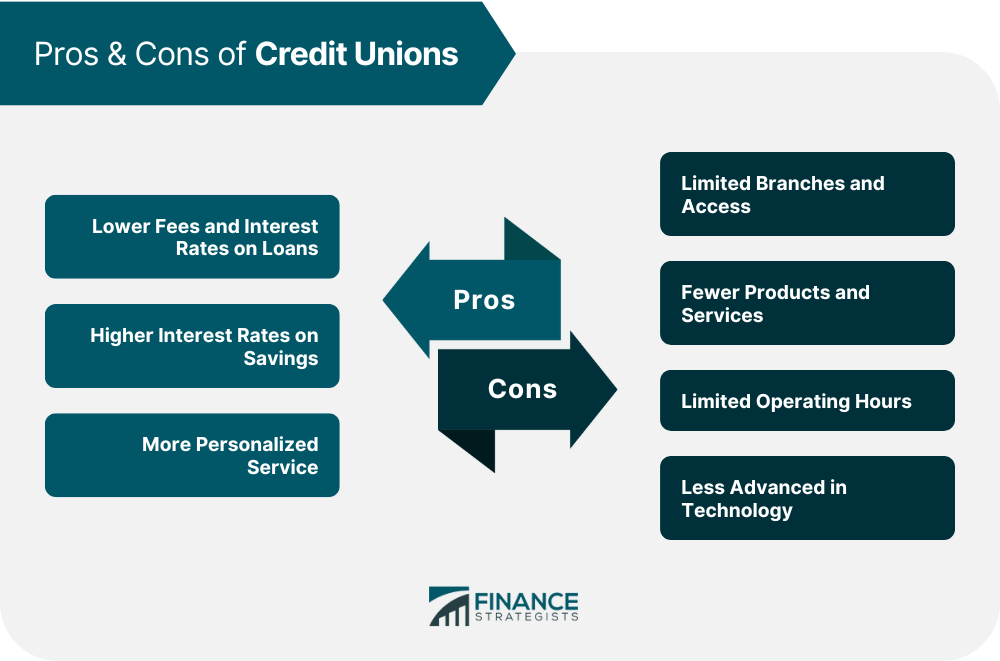

Credit history unions, with their emphasis on member-centric services and neighborhood involvement, present a compelling choice to standard financial. By prioritizing specific requirements and promoting a sense of belonging within their subscription base, credit unions have actually sculpted out a specific niche that reverberates with those looking for a much more personalized strategy to handling their financial resources.

Benefits of Credit Unions

One more advantage of credit rating unions is their autonomous framework, where each participant has an equivalent ballot in choosing the board of supervisors. Credit scores unions typically offer economic education and learning and counseling to help members boost their economic literacy and make informed choices about their cash.

Subscription Demands

Credit rating unions usually have particular requirements that individuals must fulfill in order to become members and gain access to their monetary solutions. Membership requirements for lending institution usually include eligibility based on aspects such as a person's location, employer, business associations, or other qualifying connections. Some credit report unions may serve individuals who function or live in a particular geographic area, while others may be connected with details companies, unions, or associations. Additionally, member of the family of existing cooperative credit union participants are typically eligible to sign up with also.

To come to be a member of a lending institution, people are normally called for to open up an account and keep a minimal deposit as specified by the organization. In some cases, there might be one-time membership costs or continuous subscription dues. As soon as the membership standards are fulfilled, people can enjoy the advantages of belonging to a credit history union, including access to customized financial services, competitive rate of interest, and a focus on participant satisfaction.

Personalized Financial Solutions

Individualized economic solutions tailored to individual needs and preferences are a characteristic of credit history unions' dedication to participant complete satisfaction. Unlike typical banks that typically offer one-size-fits-all remedies, cooperative credit union take a much more customized technique to managing their participants' finances. By understanding the special objectives and scenarios of each member, lending institution can give customized suggestions on savings, investments, finances, and various other financial products.

:max_bytes(150000):strip_icc()/6-benefits-of-using-a-credit-union.aspx_final-6e501699186e429ab6458d9e36ebe4a1.jpg)

Furthermore, credit report unions usually offer reduced costs and competitive rates of interest on fundings and financial savings accounts, further enhancing the customized financial solutions they offer. By concentrating on private needs and supplying customized services, lending institution set themselves apart as trusted monetary partners devoted to aiding participants thrive monetarily.

Area Involvement and Support

Area involvement is a foundation of credit unions' objective, reflecting their commitment to supporting neighborhood campaigns and fostering significant connections. Lending institution actively participate in area occasions, sponsor local charities, and arrange economic proficiency programs to inform participants and non-members alike. By spending in the areas they offer, lending institution not only reinforce their partnerships but additionally add to the total wellness of society.

Supporting local business is an additional method credit score unions demonstrate their dedication to local areas. Via providing little business fundings and monetary recommendations, cooperative credit union help entrepreneurs grow and stimulate economic growth in the location. This support goes beyond simply economic support; cooperative credit union often supply mentorship and a knockout post networking chances to aid local business are successful.

Furthermore, credit rating unions regularly participate in volunteer work, urging their workers and participants to give back through different community solution activities - Hybrid Line of Credit. Whether it's getting involved in local clean-up events or arranging food drives, credit score unions play an energetic role in boosting the top quality of life for those in demand. By focusing on community involvement and support, credit rating unions absolutely embody the spirit of participation and common aid

Online Banking and Mobile Applications

In today's digital age, contemporary banking comforts have actually been revolutionized by the extensive fostering of on-line systems and mobile applications. Debt unions are at the forefront of this digital change, providing participants safe and convenient ways to handle their funds anytime, anywhere. Electronic banking solutions supplied by lending institution make it possible for participants to inspect account equilibriums, transfer funds, pay bills, and watch purchase history with just a couple of clicks. These platforms are designed with user-friendly interfaces, making it easy for members to browse and accessibility essential financial attributes.

Mobile apps used by lending institution even more boost the banking experience by giving added adaptability and access. Members can do various financial jobs on the go, such as transferring checks by taking a picture, getting account notifications, and even getting in touch with client assistance straight through the application. The protection of these mobile applications is a leading concern, with attributes like biometric verification and encryption methods to guard sensitive information. In general, lending institution' online banking and mobile apps encourage members to manage their funds efficiently and securely in today's hectic digital globe.

Conclusion

In verdict, cooperative credit union offer an unique banking experience that focuses on area involvement, customized service, and member fulfillment. With reduced costs, competitive interest rates, and tailored monetary services, lending institution accommodate individual needs and advertise financial health. Their democratic structure worths participant input and supports neighborhood areas through different campaigns. By joining a lending institution, individuals can elevate their banking experience and build strong partnerships while taking pleasure in the benefits of a not-for-profit banks.

Unlike financial institutions, credit score i thought about this unions are not-for-profit organizations possessed by their participants, which commonly leads to reduce costs and far better rate of interest rates on cost savings accounts, financings, and credit scores cards. Additionally, credit score unions are recognized for their individualized client solution, with personnel participants taking the time to recognize the special financial objectives and challenges of each participant.

Credit unions typically provide economic education and therapy to help members improve their financial proficiency and make educated decisions about their cash. Some credit rating unions may serve people who function or live in a certain geographical location, while others might be associated with specific business, unions, or associations. In addition, family members of present credit history union members are often eligible to sign up with as well.

Report this page